IN 2021, PETERSON NEEDED MARKETING DUE DILIGENCE SUPPORT ON A LARGE CONSUMER HEALTHCARE INVESTMENT. THEY CALLED ON US TO GO DEEP AND DELIVER REAL INSIGHT.

The Challenge

Peterson Partners (investments include Allbirds, Lucid, Cotopaxi, Breeze Airways) was exploring a major investment in a consumer healthcare business in the fall of 2021. They knew that differentiated insights into customers, competitors and macro trends would make the difference in ultimate investment performance. Some of the most important questions centered on consumer and competitor behavior. What was driving recent growth in demand for the product? What competitors were capturing that demand? How could they better reach target customers?

The solution

Peterson partnered with Fluid to perform a comprehensive analysis of market conditions using our proprietary analytics platform, Heimdal, and statistical analysis on publicly available consumer, competitor and market data.

Our analysis covered the following areas:

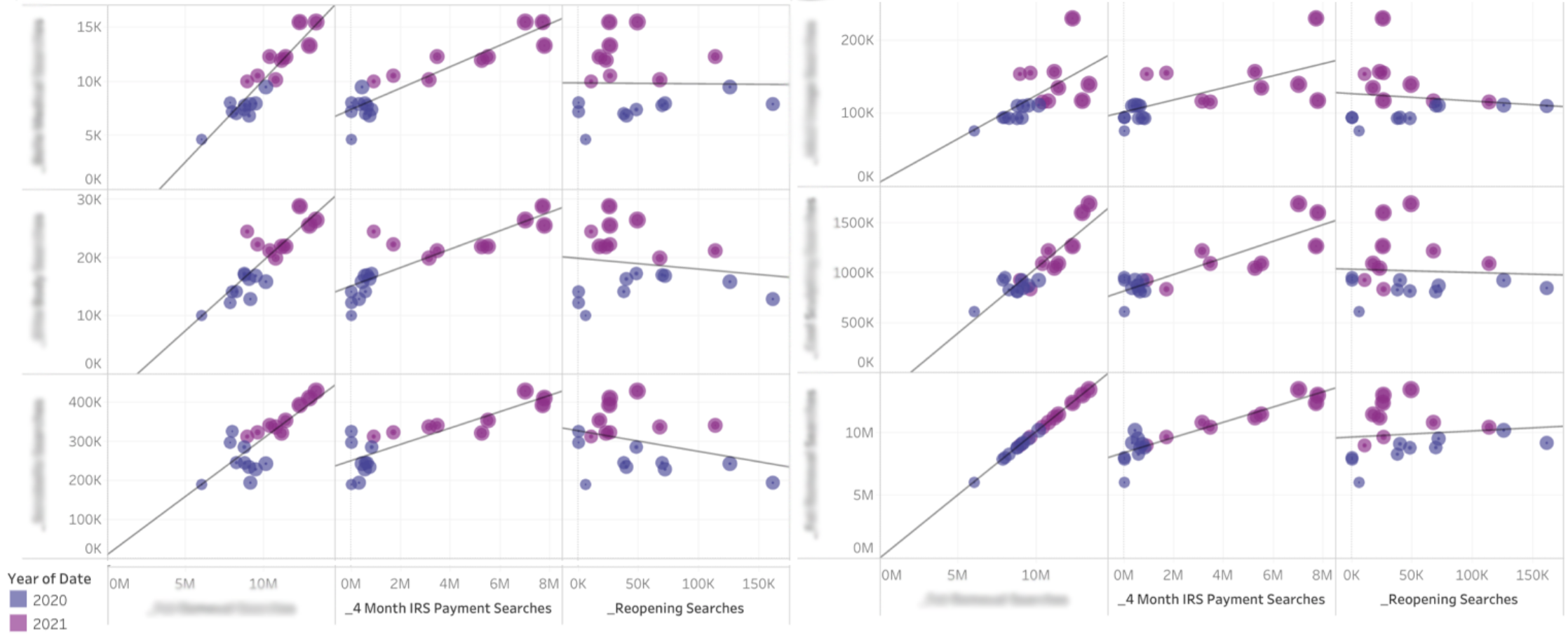

- Macro Economy: We were able to quantify with high statistical confidence how much recent paycheck protection payments from the U.S. government were driving demand improvements in the business, maximizing negotiating leverage for Peterson with current ownership.

- Competitive Landscape: Our analysis of search trend behavior showed which modalities were growing (based on consumer interest over time) and which were shrinking, informing which parts of the business were true growth areas.

- Consumer Insights: We were able to map correlations between core consumers and other brands and websites. That data informed a more holistic view of the target consumer and highlighted targeting opportunities and placements that were currently underexploited by the current ownership.

- Geographic Insights: Leveraging Heimdall, we were able to generate a heatmap of demand based on Google search interest in this category (down to the intersection level) to inform current clinic performance and the new, post acquisition clinic buildout roadmap.

The Numbers

STATISTICAL

CORRELATIONS

ANALYZED

EQUITY

INVESTMENT

FINALIZED

That’s not all, folks.

Cameron Construction

What else can we do?

Cameron Construction